JUNE REPORT- 2024

An Indian ETF and a French Fry Stock That Has Historically Outperformed the S&P

Introduction:

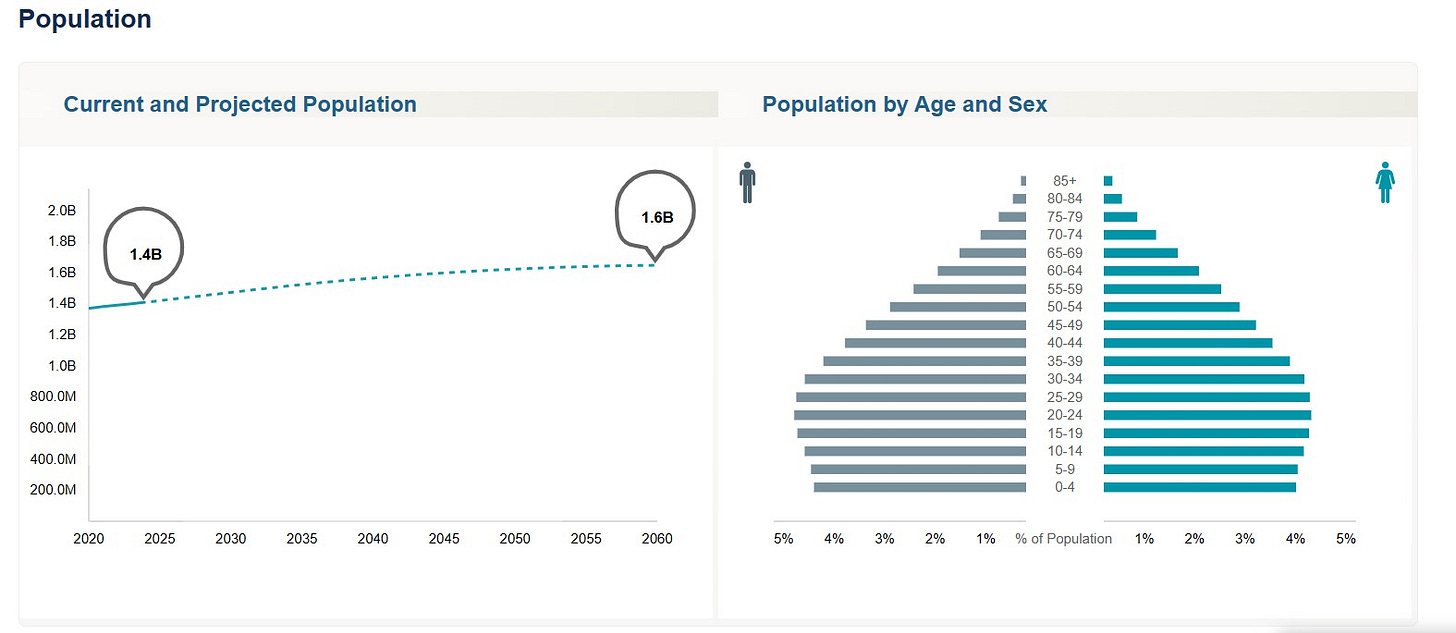

India has now come across my radar as being a part of the global economic sector to have investment in going forward. The logic behind this is to gain exposure to the fastest growing economy among G20 countries. The fundamentals for India have been strong with strong organic growth in population throughout the last decades, although that growth rate will slow going forward as birth rates in India have come down dramatically from where they were, making India the most populated country in the world now after they recently surpassed China.

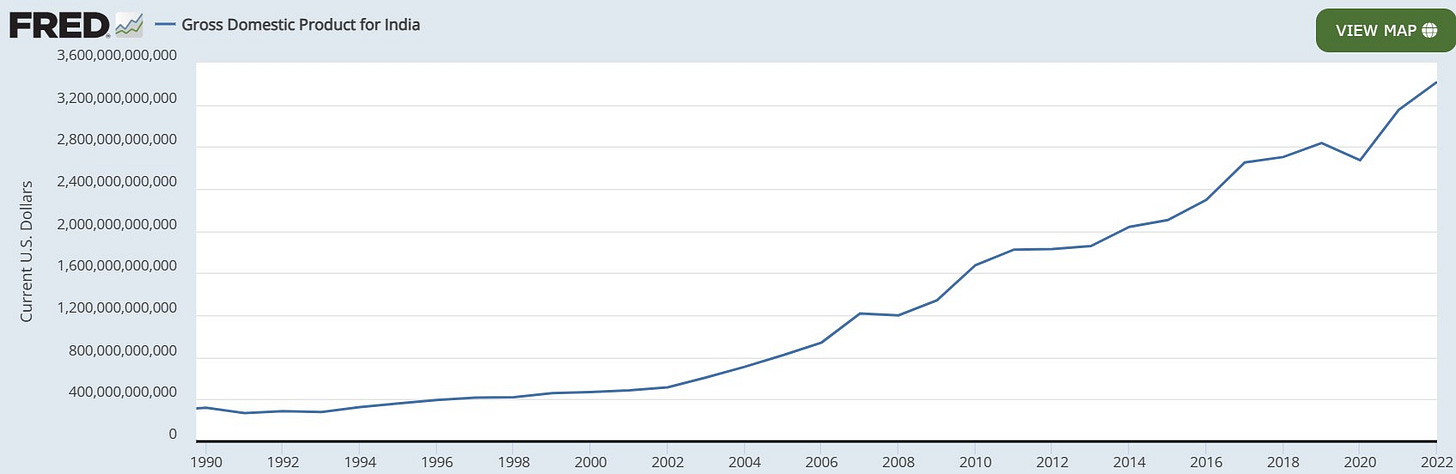

As you can see from the chart, since 1990 through the end of 2022, India has gone from about $320.9 billion in GDP to about $3.417 trillion in GDP. This represents an average compounded annual growth rate of about 7.67% over those 32 years.

Additionally, you have an emerging market with plenty of individuals who are expected to come out of extreme poverty as India emerges and develops. This would increase the consumer base over the years, which is what is going to be a huge tailwind for the Indian economy.

As we can see from the chart below, the tailwinds for India are massive from the demographics presented below where you have a huge cohort below the age of 50 and over half of the population under 30. This will allow India strong fundamentals for future growth into the future even with a decline in current birth rates.

Finally, India is a strategic investment on the geological front, which has historically close ties to both western and eastern countries, which can be beneficial as we see a new multi-polarized world emerging between BRICS+ countries and the West. So, I like the idea of having exposure to India because of a bullish top-down investment thesis on the Indian economy as well as gaining geographic diversification.

What sectors and individual companies are going to be the best performers and have the best brands in India is very unknown to me as I do not have a lot of knowledge on individual Indian companies and deep expertise inside of India in general. Therefore, in this application, it is much more appropriate for me to target an ETF that gives me broad exposure to the Indian macro-economy, something I rarely engage in, buying an ETF instead of individual stocks.

Keep reading with a 7-day free trial

Subscribe to Brian’s Substack to keep reading this post and get 7 days of free access to the full post archives.